Your underinsurance jargon buster

Are you underinsured?

Maybe there’s a time and place for jargon but when it comes to your Buildings Insurance, there’s no room for misinterpretation.

Did you know that in 2022, fewer than one in ten properties are properly insured? Due to rising construction costs, inflation and a slew of other factors, underinsurance is more prominent than ever. To ensure your cover is right, it’s worth having a conversation with your broker or insurance provider now if you haven’t already.

You’ve likely already heard some terms flying around, so we’ve taken the liberty of spelling these out in clear language, so you know exactly what they mean. Jargon. Busted.

Sum Insured

When you insure a building, you are responsible for determining the amount you want to be covered for, or the Sum Insured, based on how much it would cost to rebuild your entire property from scratch. Your insurer will decide how much to charge you for the insurance based on this amount.

The building’s sum insured is the maximum amount of money your insurer will pay out if you claim on your Buildings Insurance. This includes the cost of professional fees such as architects, demolition costs and labour. The sum insured of your property can be very different to the market value of your property.

Average Clause

If you insure your building for less than it’s worth, the average clause determines how much your insurer will pay out when it comes to making a claim.

For example, if you insure a property that would cost £600,000 to rebuild for £300,000, you are underinsured by 50%. Due to this, the average clause dictates that whenever you claim on your policy, your insurer will only pay out a maximum of 50% of any claim you make.

No matter how small the claim is, you will always be subject to that 50% limit. Therefore, If you claim for £5,000, you will receive a maximum of a £2,500 payout.

Note: This is a very simple example, you can be underinsured for any amount and the percentage that you are underinsured by will be applied to every claim you make – no matter how small the claim.

Index Linking

If index linking is applied to your policy (this can be done at no extra cost to you), your sum insured will increase at each annual renewal to match inflation. This means that your policy will still account for the inflationary rise in the cost of materials and labour.

How to avoid underinsurance

As well as reviewing your Buildings Insurance annually, it’s important to review your insurance any time you make a significant change such as a renovation or, for commercial buildings, during times of peak stock levels. It is important that you either undertake a full survey by a RICS chartered surveyor or a desktop review by RebuildCostAssessment.com will provide you with an accurate valuation of your property.

To find out more, or to request a no obligation review of your covers just give us a call on 01623 650750

Range Rovers are being targeting, which makes them difficult to insurer, especially those based in London. Read this article from Autocar to find out more.

https://www.autocar.co.uk/car-news/new-cars/insurers-refusing-cover-london-based-range-rovers

Coalition – Cybersecurity Guide for Small Businesses

UK Flood Guidance and Mitigation

We are on our way our of Winter, however Flooding is still an issue throughout the year and with climate change resulting to increased rainfall and rising sea levels, we may not see an improvement any time soon. Read this helpful flyer from Aviva to see how you can lessen the risk of being affected by Flooding.

CCTV: DON’T GET CAUGHT OUT

Noble Design and Build of Telford, Shropshire, which operates CCTV systems in buildings across Sheffield, broke data protection laws by failing to comply with an Information Notice.

The ICO sent a letter to the company, raising concerns that it didn’t have the appropriate signage in place to alert people to the CCTV. It also notified them of its legal duty to register with the ICO. The ICO sent out another letter on 11 October 2017 and a final email on 25 January 2018.

The ICO then sent an Information Notice, under section 43 of the Data Protection Act 1998, compelling the company to comply.

In July 2018, Noble Design and Build was convicted at Telford Magistrates’ Court. They were:

- Fined £2,000 for failing to comply with an Information Notice, under section 47 of the Data Protection Act 1998

- Fined £2,500 for processing personal data electronically without having notified when required to do so, under Section 17 of the Data Protection Act 1998

- Ordered to pay costs of £364 and a victim surcharge of £170.

AIPS QUARTERLY NEWS LETTER

We have put together a news letter that will be released every quarter to advise of important changes, industry news and helpful details on insurance related risks. Take a look to make sure you’re in the know.

There has been an update to the 2021’s Whiplash Reforms – there are now limits to the compensation that can be received through whiplash claims, with the aim to deter or reduce the number of fraudulent whiplash claims. For more information, take a look at the attached document.

What’s happening with home insurance premiums?

Have a look at this article from Insurance Business UK which looks to explain what could be next for home premiums.

How much should you insure your Rental Property for?

Get help on how to insure your Rental Property – check out this handy link from RebuildCostASSESSMENT.com

Driverless Cars – Are we nearly there?

Read this article from CRIF to find out more about the race towards driverless vehicles

The New Motor Vehicles (Compulsory Insurance) Act 2022

The Motor Vehicles (Compulsory Insurance) Act has created a huge differences between UK and EU compulsory motor insurance legislation. Check out the link below to make sure you are up to speed on what has been passed.

https://www.clydeco.com/en/insights/2022/04/compulsory-motor-insurance-bill-vnuk-vehicle-use

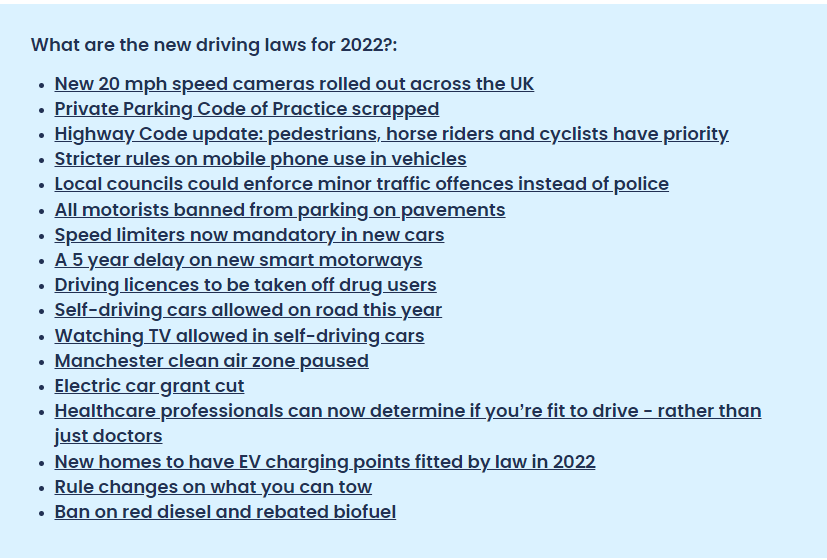

NEW DRIVING LAWS THAT COULD AFFECT YOU

New driving laws and rules for 2022 – Confused.com

In March a new law came into effect regarding the use of mobile phones when behind the wheel. Take a look at this guide for more information

Welcome to Summer

Summer is here, hot and heavy! Take a look at these pages of the Aviva risk management bulletin which covers some of the key issues employers and business owners need to be aware of during these summer months.

Inflation and Insurance

The ongoing increases in inflation is affecting every aspect of the economy, including the insurance and poses a risk to commercial insurance holders of being under insured. Read the Lockton’s article on how rising inflation creates an underinsurance risk for details on this topic Rising inflation creates underinsurance risk | Lockton

The cost of building materials has surged over recent months. For homeowners, it’s more important than ever to check your insurance policy to ensure you’re adequately covered

The HSE has shared details of how the on-road enforcement approach used by the Driver & Vehicle Standards Agency and the police is changing on 1st May 2022, which you may find useful. The text below is from the HSE:

The fundamental principles of load security have not changed. Anything transported on or in a road-going vehicle or trailer must be secured so that it does not slide, tip, or bounce off the vehicle or move around inside it so that it affects the vehicle handling.

Employers and the self-employed whose work activities could put others at risk should consider load security in conjunction with work at height, manual handling, and other relevant issues when assessing the risks in their business.

The updated Categorisation of vehicle defects document can be accessed here: How vehicle defects are categorised in roadside checks and vehicle tests – GOV.UK (www.gov.uk)

- Palletised goods should be securely attached to the pallet and must be stable on it before they are loaded onto the vehicle or trailer and secured. A load that is fundamentally unstable can never be secured correctly.

- Loads such as poles, pipes, and boards that are loaded at an angle over the headboard of a flatbed or sided flatbed must be secured using a minimum of two loop (choke) lashings unless they are individually clamped to the headboard. It is not sufficient to use frictional lashing, where the strap passes up and over the load, as this will not necessarily prevent load movement once the vehicle is moving. Several fatal incidents have occurred where items have slid off the headboard and struck oncoming vehicles.

- Lifting equipment including lorry-mounted cranes and their attachments should not be used for load securing. Doing so risks damaging the lifting equipment, which is usually not designed to be used for this purpose.

- The gap between the front of the load and the headboard must be less than 30 cm unless additional securing has been used to prevent forward movement of the load.

- Where the vehicle or trailer structure is used as part of the load securing system, it must be constructed to BS EN 12642 XL or technical equivalent and the load must be in positive fit inside it. For heavy loads such as bricks or blocks, particularly on multi-drops, it will usually be necessary to lash the load inside the trailer and the XL rating will be a back-up in case of failure of the primary restraints.

- Loads carried in skips, bulk tippers, and any other open-topped vehicle, trailer, or container must be sheeted or netted for transport.

- Stacked empty skips must be lashed to the carrying vehicle.

- Goods carried in a bulk tipper must not be loaded over the height of the sides unless sheeted with either a rigid cover or a rated sheet that completely covers the load area.

- Goods carried in vans must be secured and a bulkhead fitted between the load compartment and the cab to prevent injury to the driver and any passenger/s in the event of the load moving forward, unless another means of preventing forward movement of equal efficacy to a bulkhead is used.

Note that in addition to the lorry-mounted crane bullet point above, specific mention of ‘crane support legs’ is made in the linked-to ‘Categorisation of vehicle defects’ document.

HSE (the Health and Safety Executive) will be visiting construction sites across the UK throughout Autumn 2021.

HSE are able to inspect sites they have not seen in the previous three months, and aim to visit sites of all types and sizes, they must however give reasonable notice in writing when they intend to carry out a formal inspection.

The HSE are the UK’s national regulator for workplace health and safety, committed to improving the health of construction workers. This year, HSE is especially focussing on respiratory risks and occupational lung disease. HSE inspectors will look at the way work is designed and planned, and the measures in place to protect workers from harmful exposure to dust. Because of the high risk, inspections will be more frequent.

https://thejournal.cii.co.uk/features/2021/10/22/flood-rising-tide FLOOD – RISING TIDE – Insurers head to COP26 with growing concerns about extreme weather risk

What do changes to the highway code mean?

On the 29th of January, a new highway code came into effect with 3 significant changes that aim to reduce the risk around vulnerable users. Such changes include:

- Drivers no longer have priority at junctions

- Cyclists can ride wherever they feel the safest / most visible ·

- The ‘Dutch Reach’ is the recommended method of vehicle exit

These changes place more responsibility on drivers of larger vehicles

Flood Cover

Important Information for Customers to obtain flood cover

Why am I being provided with this document?

The information provided in this document is designed to improve access to obtain flood cover and to offer improved access to suitable and affordable insurance products for those in flood-prone areas.

What are the circumstances in which this could apply to me?

The following factors determine when this information is relevant to you:

- You have been offered a household policy with a flood exclusion

- You have not been offered a household policy and flood risk is the major reason cover was declined

So how can you help me?

We would like to provide you with details of the ‘Flood Insurance Directory’, which is a publicly available directory, that only lists firms that provide cover for residential buildings and/or contents insurance for consumers who are struggling to obtain flood insurance. The directory will also show you enough information about each firm listed so you can make an informed decision about which firm might meet your needs.

What are the benefits?

Some of the advantages of using the directory make it easier for you to navigate the available markets and make it more likely in finding a firm who will be able to provide the relevant cover required.

- Access to specialist providers for your needs

- The specialist’s listed have been through a vetting process

How can I access the Flood Insurance Directory?

The Flood Insurance Directory can be accessed on the BIBA website following the link below:

Find Insurance – The British Insurance Brokers’ Association (biba.org.uk)

or

Telephone – 0370 950 1790 Monday to Friday 9:00AM – 5:30PM

(Speak to a dedicated team of experts who can help you to find insurance for your specific needs)

What to do against rising car thefts

In the past year, 1000 vehicles were stolen every week on average, according to recent figures*. In addition to this increasing trend, the values of the vehicles targeted have also grown to include more prestige models. To help protect your clients’ vehicles, it is vital to consider having the right type of tracker. This choice is crucial as the incorrect one could mean your client would not be covered should their vehicle be stolen. The following security options could be needed, depending on the value of the vehicles, where they’re parked and the risk of theft.

Pro-Active GPS Tracker: Uses satellite GPS (global positioning system) technology to protect your client’s vehicle. This is equivalent to the Thatcham category S7 or the old Thatcham category 6.

Automatic Driver Recognition System: Uses automatic driver recognition (ADR) technology to protect your client’s vehicle. This requires that the tracker has a separate driver ID system in addition to the keys. Therefore, if the vehicle is stolen without the driver ID, for example via replicated keys, the tracker will be activated. This would be a tracker equivalent to Thatcham category S5 or the old Thatcham category 5.

Immobilising Automatic Driver Recognition System: Similar to the above but with an active separate immobilisation circuit linked to an ADR tag. This means that without the driver ID tag, the vehicle simply will not start. Some of these systems allow the client to safely stop the vehicle remotely. These are sometimes referred to as Category S5+ Trackers.

Immobiliser Condition: As well as tracking, very high-risk vehicles may require an additional immobilising system that works independently of the tracker and factory fitted systems. This prevents the vehicle from starting regardless of if the thief has the keys or even the driver ID tag.

Click here to find top tips for preventing your client’s vehicle from being stolen.

Important Information for Customers with Pre-existing Medical Conditions

We are obliged to inform you of how to improve your access to travel insurance policies that includes cover for more serious medical conditions.

The following factors would determine when this information is relevant to you:

- You have not been offered, or we/the insurer, have declined a quotation wholly or partly due to a medical condition

- Your policy has been cancelled, wholly or partly, due to a medical condition

- You have been offered a policy with a medical condition exclusion, which cannot be removed from the policy

- You have been offered a policy with a medical condition premium of £100 or more

- You have been offered a policy in respect of which the medical condition premium is not known.

We would like to provide you with details of a ‘Medical Cover Firm Directory’, which is a publicly available directory that only lists firms that provide, or arrange, travel insurance policies that cover more serious medical conditions. The directory will also show you enough information about each firm listed so you can make an informed initial choice about which provider might meet your needs.

Some of the advantages of using the directory make it easier for you to navigate the available market and make it more likely in finding a firm who:

- Is willing to offer cover for your condition

- Is willing to offer cover for your condition without specific exclusions

- Is willing to offer cover for your condition at a more affordable price.

The Money and Pensions Service (MaPS) has launched a travel insurance directory on its Money Advice Service website which can be accessed here:https://traveldirectory.moneyadviceservice.org.uk/en

Consumer enquires about the directory can be made to the Money Advice Service’s Customer Contact Centre, which is available Monday to Friday, 8am to 6pm using the details below:

Telephone – 0800 138 7777

Email – enquiries@maps.org.uk

Address – The Money Advice Service, Holborn Centre, 120 Holborn, London, EC1N 2TD

FLOOD COVER, PLEASE TALK TO US!

Flooding can be devastating to both homes and businesses, causing huge amounts of property damage along with the pain and frustration of dealing with the aftermath, which can take months to rectify. The environment agency has estimated that 2.4 million properties in England are currently at risk of river or coastal flooding, and there are an additional 3 million properties at risk of surface water flooding; 600,000 of these are at risk of both.

The devastation that flooding can cause to homes and businesses can be huge. Of the 28 million properties in the UK, more than five million are at risk of flood. On current trends up to 20,000 houses are likely to be built this year in flood risk areas.

Flood Re’s purpose is to promote the availability and affordability of flood insurance for eligible homes, while minimizing the costs of doing so, and manage, over its 25 year lifetime, the transition to risk reflective pricing for household flood insurance.

If you need any help or support with accessing insurances to include flood cover, please talk to us.